Terms of Business

Scooch Embedded Pet Insurance - Terms of Business and Important Details

Who are we?

Scooch Embedded Pet Insurance policies are arranged and administered by Scooch Pet Limited. Our office is located at: 107 Cheapside, 9th Floor, London, EC2V 6DN. Scooch Pet Limited are an appointed representative of Tedaisy Affinity Services Limited.

Policies are provided to Scooch Pet Limited on behalf of the Insurer by Perfect Pet which is a trading name of Tedaisy Insurance Brokers Limited (Registered in England and Wales no 09981861), an appointed representative of Tedaisy Underwriting Limited who is authorised and regulated by the Financial Conduct Authority firm reference 504604). Registered office at Warner House, 123 Castle Street, Salisbury, SP1 3TB.

Policies are underwritten by Antares Insurance Company Limited, (Company Registration

Number 13763689), 21 Lime Street, London, United Kingdom, EC3M 7HB. Authorised by

the Prudential Regulation Authority and regulated by the Financial Conduct Authority under

firm reference number 967451.

What to do if you need to complain?

If you need to make a non-insurance related complaint please contact Scooch by email @ woof@scooch.pet. Alternatively, you can write to us at 107 Cheapside, 9th Floor, London, EC2V 6DN.

For all Insurance related complaints please email our Complaints Department at customerresolutions@perfectpetinsurance.co.uk or telephone 01992 667330. Or, write to Customer Resolutions Manager, Perfect Pet Insurance, Warner House, 123 Castle St, Salisbury, SP1 3TB.

If you are not satisfied with the final decision, you may refer your complaint to the Financial Ombudsman Service (FOS), Exchange Tower, London, E14 9SR, telephone 0800 023 4567 from a landline or 0300 123 9123 from a mobile phone. Details on how to progress your complaint with the FOS can be found at www.financial ombudsman.org.uk.

Awareness of policy terms

When a policy wording is issued it is your responsibility to read it carefully, as it is that document and the schedule that make up the policy, which you have purchased. If you are in doubt over any policy terms and conditions, please contact us promptly.

Advice

You will not receive advice or recommendation from us. We will give you information about a product but cannot make a decision for you.

Cancellation

If, once you have registered for a policy and you find that the cover is no longer required, you can cancel the policy at any time. You must notify us of your request to cancel by writing to us at Scooch 107 Cheapside, 9th Floor, London, EC2V 6DN.

Alternatively, you can email us at woof@scooch.pet. Upon receipt of your cancellation request we shall cancel your policy as instructed. The charges due following cancellation are outlined below and in your policy document.

Who regulates us?

Scooch is an appointed representative of Tedaisy Affinity Services Limited, registered in England and Wales company number 08344708 at Warner House, 123 Castle Street, Salisbury, SP1 3TB and who is authorised and regulated by the Financial Conduct Authority, firm reference number 710589.

You can check this information online using the Financial Services Register at https://register.fca.org.uk/ or by contacting the Financial Conduct Authority Consumer Helpline on 0800 111 6768.

Cover is offered from Antares Insurance Company Limited.

Antares Insurance Company Limited is authorised by the Prudential Regulation Authority

and regulated by the Financial Conduct Authority under firm reference number

967451.

Our responsibilities

Throughout the period of insurance we act on behalf of both you and the insurer. We act on behalf of you when arranging cover. When we issue policy documents and collect premium payments, we act on behalf of the insurer.

We act as agents for the Insurer for the collection of premiums and refunds of premiums. Perfect Pet Insurance act as agents to the insurers for the payment of claims. This means that premiums are treated as being received by the Insurer when received in our bank account and that any claims or premium refund is treated as received by you when it is paid over to you.

Charges

We arrange the policy with the insurer on your behalf. You do not pay us a fee for doing this. We also make the following charges:

|

All Mid-Term Adjustments |

No Charge |

|

Subject Access Request |

No Charge |

|

Policy Cancellation (Administration Charge) |

No Charge |

|

Refunds |

N/A as insurance is provided free of charge |

Payment Default

|

Rejected payments |

In the event of a payment default, you have 7 days from the date of default to contact us and arrange payment. If payment is not received your policy will be cancelled from the default date. A pro-rata charge for your period on cover will be made or where a claim has been made, the remaining premium for the policy year will be charged. |

|

Cancelled payments |

In the event your payment instruction is cancelled, you have 7 days from the date the payment due date to contact us to arrange payment and provide us with valid payment information. If payment is not received, your policy will be cancelled from the date we are notified your payment provider is cancelled. A pro-rata charge for your period on cover will be made. Where a claim has been made, the remaining premium for the policy year will be charged. |

Renewal

All our policies are annual policies, which run for 12 consecutive calendar months effective from the commencement date. Before the end of each 12-month period we will contact you by email or by post where no valid email address is provided,to inform you about any changes to the premium and/or policy terms and conditions for the next 12 months.

If you pay your premium by monthly instalments there is no need for you to take further action, your policy will automatically continue at the end of the 12-month period, subject to policy terms and conditions. A further 12 equal monthly payments will be taken, reflecting the premiums stated within your renewal documentation. If you do not wish your policy to renew at the end of the 12-month period, please call us once you have received your renewal invitation.

If you pay annually by debit or credit card, you need to contact us to make payment before the renewal date.

Scooch may change the insurer or administrator of your policy at renewal. If this happens, you will be notified of any changes when your renewal documents are sent to you. If you do not want us to change the underwriter, you must notify us and we will not be able to renew your policy.

Your renewal documents will be sent to you by email at least 14 days before the renewal date of your policy. We will email the last email address given to us by you. We are unable to prevent these from going into your spam or junk folders so please check these folders as well as your current inbox. If your email address changes between the policy start date and renewal date, please inform us so that we can keep your record up to date.

If you have not provided us with an email address, we will post renewal documents to your last known address.

Call Recording and Monitoring

We record and/or monitor telephone conversations to ensure consistent service levels, to prevent/detect fraud and for training purposes.

The information you gave us

We rely upon the information you provide to us to decide whether to insure your pet and the terms and conditions under which we will offer cover. You must provide honest and accurate answers to the questions we ask during the application process,such as all known factors relating to the health, condition and behaviour of your pet in answer to our questions. This is important as it may influence any decisions we make regarding your application. You must use reasonable care in response to the questions and statements concerning this insurance. If you fail in your duty of taking reasonable care not to make a mis- representation to us, your policy may be cancelled, or treated as if it never existed, or your claim rejected or not fully paid .

Fraud Prevention and detection

In order to prevent and detect fraud we may at any time:

We and other organisations may also search these agencies and databases to:

How we use your data

Scooch is the data controller of any personal information given to us about you or other people named on the policy. It is your responsibility to let any named person on the policy know about who we are and how this information will be processed.

We believe in keeping your information safe and secure. Full details of what data we collect and how we use it can be found in our privacy policy which you can access via https://scooch.pet/policies/privacy-policy or by requesting a copy from our Data Protection Officer (contact details below). Please also see your insurance policy document.

Where you have given us your consent to do so, we will send you information about products and services of ours or other third parties which may be of interest to you via telephone, letter or email (as you have indicated).

You have a right at any time to stop us from contacting you for marketing purposes or giving your information to other third parties. If you no longer wish to be contacted for marketing purposes then please contact us by e-mailing woof@scooch.pet.

Under Data Protection Laws you have certain rights; these include for example, a right to understand what data we hold on you and a right to ask us to amend that data if it is incorrect. If you have any questions about how we use your data, or to exercise any of your data rights please contact our Data Protection Officer at:

Data Protection Officer

Scooch Pet Limited

9th Floor 107 Cheapside, , London, GB, EC2V 6DN

For full policy terms and conditions please see your policy wording.

Law applicable to this policy

Unless we agree otherwise:

Financial Services Compensation Scheme (‘FSCS’)

If we are unable to meet Our liabilities you may be entitled to compensation under the Financial Services Compensation Scheme (FSCS). Further information about compensation scheme arrangements is available at www.fscs.org.uk, by emailing enquiries@fscs.org.uk or by phoning the FSCS on 0800 678 1100.

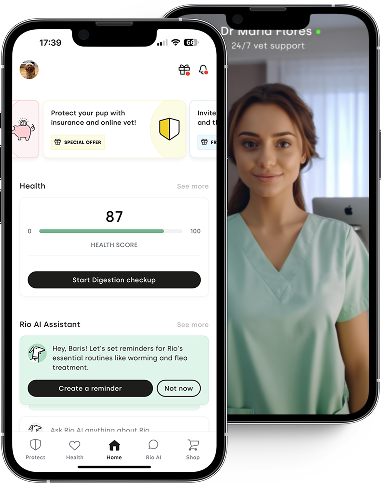

Scooch health

Scooch health